Are you one of those people who are constantly asking themselves, "Why am I always broke?" Or do you have a good job with a nice salary, but your bank account is always empty? Well, in this article, I'll share with you eight reasons why most people will always be poor, regardless of how much money they make. So, make sure to read this article to the end to find out what you can do to change the situation.

And if you're a returning subscriber, do you ever wonder why some people are so poor while others appear to have so much? Well, in a study by National Public Radio, the Kaiser Family Foundation, and Harvard University’s Kennedy School on the causes of poverty, 48% of the respondents criticized the nonstop cycle of poverty as "people not doing enough to help themselves," while 45% criticized it due to circumstances.

Likewise, about half of the wealthy respondents believed that the poor weren't doing enough to help themselves, but so did about 39% of the poor. Regardless of the statistics, numerous Americans face fiscal challenges, ranging from high living and healthcare costs to taxes and government education.

For some, these numerous burdens make them feel as if they will always be poor. While some people are trapped in poverty due to a series of poor financial decisions they make every day and adverse circumstances, such as unstable job opportunities compared to those the wealthy have. Fortunately, there are strategies you can use to build your wealth over time. But before you can start creating wealth, you must first identify the habits that are straining your finances. And that's what I'll be discussing in this article.

1. You Do Not Save

According to Bank rate data from 2023, 56 Americans would not be suitable to cover a $1,000 unanticipated bill with savings. In other words, Americans are generally under-saved. thus, they're prone to debt which results in an endless cycle of poverty. Contrary to what numerous people suppose, you don't need to earn a certain quantum before you can start saving. It's veritably important to prioritize saving anyhow of your age, stage in life, or how little income you earn. When it comes to saving, it's the habit that matters, not the quantum.

It all comes down to precedence, and if you don't prioritize saving, it'll be delicate to save no matter the quantum you make. Whether you are saving for a new auto, a house, or your withdrawal, you will not get there unless you make saving a priority. Many people assume that setting small quantities away will noway add up, but it does.

Putting a little bit away each stipend will ultimately add up to the larger quantum you'd hoped for. Making saving a habit isn't easy. It needs practice. However, you're most likely to stick with it, If you start doing it automatically each pay period. And flashback, the before you start, the better the chances of a financially secure future!

2. You don't set fiscal pretensions

Do you have a fiscal plan for the future? Or do you just go with the flow? The harsh reality is that there's a significant difference between someone who works with a plan and someone who lives life as it comes.

Poor planning may not be the cause of your poverty, but it can keep you there. You can have all the conviction in the world, but if you don't have an established plan outlining how much you intend to earn and save, or how you plan to achieve your fiscal pretensions, you're most likely counting on luck to move from poverty to prosperity.

To get out of profitable difficulty, one must have a detailed financial plan for the future. You have to produce and stick to realistic short-term and long-term fiscal pretensions. Identify and jot down what you hope to negotiate in a day, week, month, or indeed 5 times. You need to fantasize about your future and work out a realistic path to get there.

Doing this will motivate you to do better when it comes to your finances. So how do you come up with a fiscal plan? Begin by making a list of your fiscal pretensions, both those you are working toward and those you have not begun working on yet. After that, prioritize these pretensions grounded on the weight of their significance. also write down the exact details of each thing, similar to the timeline, the quantum of plutocrat demanded, and the quantum you’ve formerly saved. This will help you figure out what it takes to negotiate each thing and produce a plan.

However, you can hire a fiscal diary, If you need help designing a fiscal plan. still, if you're interested in learning how to do it, there are several YouTube voids and online papers that could be of help. So make great use of similar coffers.

3. You always spend further than you earn

So frequently, we're advised not to live beyond our means. This is a statement that sounds like a veritably practical way to avoid fiscal stress.

But in reality, it’s easier said than done. Do you ever find yourself looking forward to the coming payday from the middle of the month? Not because you've invested but because you're on the verge of running out of cash? If yes, also this should tell you that you're living beyond your means. Today, the internet has made everything veritably accessible to us.

It's so easy to buy an item from the comfort of your home. What is further, social media doesn't make the situation any easy. In a recent check, 57 of millennials reported making unplanned purchases because of what they saw on social media.

This goes to show how important the impact of social media has on our spending habits. More than ever, it's easier to get swayed by the flashy lives online.

You see people exhibiting precious buses, new iPhones, and idyllic recesses, and you want to be like them. So you spend the little you have or get loans just to enjoy the same gets. As a result, you're wedged in debt because you are trying to sustain a life you can not afford.

However, also it's time to review your spending habits, If this describes you. exclude any gratuitous particulars from your budget and begin saving.

4. You spend too important on the casing

One of the reasons utmost people are always beggared is that they spend too important plutocrats on housing. However, you're hurting your bank account, If a huge portion of your payment goes to housing. The ideal cost of the casing is set at about 30 which represents the loftiest quantum you can spend on a house and still live a reasonable life given your position of income. For case, if you earn 3200 monthly before levies, you shouldn't live in a house whose rent exceeds 960 per month. The 30 rule is a good guideline, but it isn't a universal rule.

Circumstances vary so you might have to acclimate consequently. For case, let’s say you live in a low-income area; you shouldn't pass up a$ 575 per-month apartment because it's only 18 of your yearly income. On the other hand, sticking to a 30-rent budget is not always possible in places like New York City or San Francisco, where average rental rates for a one-bedroom apartment exceed 2,000 per month. So, if your reimbursement charges are inviting, you need to consider other options else you'll be stuck living stipend to stipend. You could move to a less precious house or neighborhood. Or, you could simply find a roommate and resolve the costs.

However, please give it a thumbs up and make sure you partake in it with your family and musketeers, If you're enjoying this videotape. Also, please flash back to subscribe to this channel for further affiliated content. Thank you veritably much!

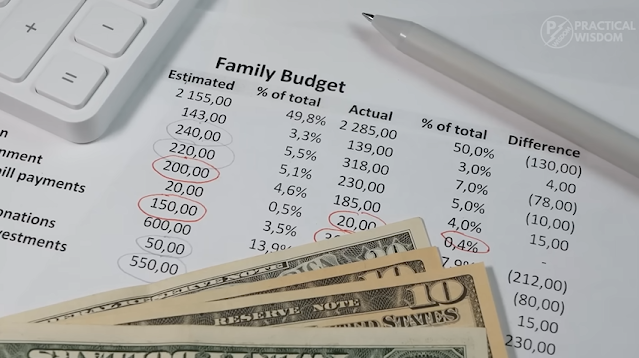

5. You don't budget

is the foundation of your particular finances. Without a budget, you're most surely fated to remain broke. People who don't have a budget generally have any idea of where their plutocrat goes each month.

And this is a veritably dangerous way to handle your income. A budget gives you an understanding of; how you spend your income each month, allowing you to know where to cut back, where to allocate more, keep a record of your pretensions, and have reasonable estimates of when your pretensions are likely to be achieved.

However, you'll always avoid a budget because it reminds you of your bad opinions If you're apprehensive about your bad spending habits but don't want to be responsible. As a result, you won't be suitable to ameliorate your fiscal situation. Though a budget can help you control your spending and avoid debt, only a small chance of Americans following a regularly streamlined budget.

A recent check by Opp Loans, a loan servicing company revealed that 73 of Americans don't regularly follow a budget. also, 1 in 10 actors revealed that they don't keep any kind of budget tall. Another check set up that 65 Americans had no idea how important plutocrats they had spent the former month. also, Generation Z is the least likely to know how important they spend. To have an effective budget, you need to track your charges regularly.

This helps you to understand your spending habits, allowing you to make better plans in the future. So, make sure you record every expenditure down to the last coin. Luckily, there are multitudinous apps available for your phone or computer that can help you in keeping track of your charges. So, make use of them!

6. You're staying for someone to save you

Having the right connections can open up doors to new openings. Still, believing that you can only succeed with the help of another person is a sure way to keep yourself poor. Several people believe that the key to their success is someone better or further intelligent than them. Some are hoping to run into an old friend or a family member who'll reveal plutocrat-making secrets to them.

While others follow those who make them believe they can attract wealth through their imagination. In the moment's world, you do not always need others to tell you what to do to be successful. There are several free AIDS courses available to help you identify openings and develop chops on your own. As Buddha formerly said, “ No one saves us but ourselves.

No one can, and no bone may. We must walk the path. ” Allowing someone to help you prosper will only keep you stagnant in life. So, stop staying for that one person or moment to change your life. That’s not how life works. You must be willing to step out of your comfort zone, work hard, and take pitfalls. You have to endure the discomfort and tiresome work of learning a skill rather than staying to discover what you can fluently succeed at.

7. You don't have an exigency fund

Before you start saving for withdrawal or paying down debt, you should work on erecting an exigency fund. An exigency fund is a good way to cover yourself from unanticipated fiscal circumstances. There is always the possibility that you will lose your job and have to manage for a while without a regular stipend.

Or you may need to make a house form or take a trip you hadn't planned for. An exigency fund will help you through that tough situation by covering some or all of the costs. This way, you aren't forced to use your savings or take out a loan.

Also, you'll be at ease because you have a backup plan in place. People will occasionally antedate an exigency fund to save for withdrawal. Which isn't bad. Still, when a large expenditure comes up, they've to withdraw finances from their withdrawal account to cover it.

Withdrawing finances from your withdrawal account should only be done as a last resort. It depletes your withdrawal savings and will nearly clearly affect penalties. For illustration, if you take an early pullout from a 401( k), you must pay a 10 penalty.

8. You calculate on one sluice of income

Having one source of income can be accessible for a time, but what happens if you lose that job? What happens if that business fails or your payment is reduced? Counting on one source of income not only puts you in a delicate fiscal situation if a commodity unanticipated occurs, but it also keeps you broke. The further income aqueducts you have, the hastily your plutocrat can grow.

It's much easier for you to reach your fiscal pretensions when you have multiple aqueducts of income because it enables you to make further plutocrats and get near to your fiscal pretensions briskly than if you only had one. However, you should consider pursuing other plutocrat-making openings, If your current payment isn't cutting it for you.

For case, you could; start up a side hustle like blogging or vlogging. You could invest in stocks or real estate. Or come a freelancer and look for well-paying jobs on websites similar to Upwork, Behance, Fiverr, and so numerous others. You've presumably heard the saying “ Don't put all your eggs in one handbasket. ” The idea is that you should broaden your sources of income to ensure that if anything goes wrong with one, you do not lose everything.

So, if you only have one sluice of income and commodity happens, it'll be disastrous for your fiscal well-being, and recovering might take you a while. Well guys, thank you so much for watching.

9. You Ignore Opportunities to Increase Your Income

If you find yourself constantly broke, it might be because you're not taking advantage of opportunities to increase your income. Consider exploring side hustles, freelancing, or finding ways to monetize your skills and hobbies. Look for ways to enhance your qualifications or seek career advancements that offer higher pay. Increasing your income can provide you with additional financial stability and help you achieve your financial goals faster.

10. You Have Unhealthy Financial Habits

Unhealthy financial habits can contribute to a constant state of being broke. This includes habits like impulse buying, excessive gambling, or relying on credit cards to cover your expenses. Take a closer look at your spending patterns and identify any destructive habits. Work on replacing them with healthier alternatives, such as creating a budget, practicing mindful spending, and establishing an emergency fund. By adopting healthier financial habits, you can regain control over your money and improve your financial situation.

11. You Lack an Emergency Fund

Without an emergency fund, unexpected expenses can easily throw your finances off balance. If you find yourself constantly broke due to unexpected costs, it's crucial to prioritize building an emergency fund. Aim to save three to six months' worth of living expenses in a separate account dedicated to emergencies. Having this financial cushion will provide you with peace of mind and protect you from falling into a cycle of debt whenever an unforeseen situation arises.

12. You're Not Seeking Support or Guidance

Managing finances can be challenging, especially when you're facing financial difficulties. It's essential to remember that you don't have to navigate these challenges alone. Consider seeking support or guidance from financial advisors, counselors, or mentors who can provide expert advice tailored to your specific circumstances. They can help you develop a personalized financial plan, provide insights on improving your financial habits, and offer strategies to overcome your financial challenges.

Remember, breaking the cycle of constantly being broke requires a combination of self-reflection, financial education, discipline, and a proactive approach to improving your financial situation. By addressing these underlying factors and implementing positive changes, you can create a path towards financial stability and achieve your long-term financial goals.

13. You're Not Taking Advantage of Available Resources

Sometimes, being broke can be a result of not utilizing the resources that are available to you. Take the time to research and explore financial assistance programs, grants, scholarships, or other resources that can provide support during challenging times. Additionally, consider accessing community resources such as food banks, job placement services, or financial literacy programs that can help you improve your situation.

14. You're Not Prioritizing Financial Education

Financial literacy plays a crucial role in managing your finances effectively. If you find yourself constantly broke, it might be helpful to invest in your financial education. There are various online courses, books, and resources available that can help you gain a better understanding of personal finance, budgeting, investing, and debt management. By increasing your financial knowledge, you can make informed decisions, develop better strategies, and ultimately improve your financial situation.

15. You're Neglecting Long-Term Financial Planning1

Living paycheck to paycheck can make it challenging to think about long-term financial planning. However, neglecting this aspect can keep you stuck in a cycle of being broke. Start by setting clear financial goals and creating a plan to achieve them. This can involve saving for retirement, building an investment portfolio, or saving for major life milestones such as buying a home or starting a family. By focusing on long-term financial planning, you can create a roadmap that guides your financial decisions and helps you build wealth over time.

Conclusion

If you find yourself constantly broke despite having a decent income, it's time to take a closer look at your financial habits and mindset. By understanding the reasons behind your financial struggles and implementing the strategies discussed in this article, you can break free from the cycle of poverty and start building a more secure financial future. Remember, financial success is within your reach, and with determination and smart financial choices, you can achieve it.